Welcome! We are the number 1 online resource for Corporate Office contact information, Store Reviews, Customer and Employee reviews and consumer complaints.

Write a complaint or review, or learn how to reach the Customer Service and Human Relations teams for the 1000 largest companies in the U.S.A,

How to Write/File a Consumer Complaint in 2 Minutes:

- Find the correct Company Page from the list below, or use the “Search function” on this page.

- Click on “Reviews and Complaints → Add”, or scroll down and click on the Comment Box, that says: “Make Sure That You Are Heard! Leave a Comment or Complaint!”

- Write your customer complaint or review.

- Click on “Post your Review”.

Thats it! It only takes a few minutes!

All Headquarters Contacts on HeadquartersComplaints.org.

Learn how to contact the Top 1000 corporations in the USA, and get your voice heard.

What We List:

- Corporate Office Mail Addresses

- Corporate Office Phone Numbers

- Corporate Office Fax Numbers

- Corporate Website Addresses

- Sic Codes (Standard Industrial Classification)

And more.

You can also write a review, ask a question or write a complaint for other visitors to see.

Likewise, you can view reviews and complaints by other users, to see if others have similar problems.

Other Consumer Report Options.

You can also file a consumer report with either:

- Consumerreports.org – Submit a Tip at //www.consumerreports.org/consumer-protection/submit-a-tip-to-consumer-reports/.

- Better Business Bureau – File a Report about a particular business or store at ww.bbb.org/consumer-complaints/file-a-complaint/.

- FTC – Federal Trade Commission. To report fraud, identity theft, or unfair business practices, visit ftc.gov/complaint, then click on the “FTC Complaint Assistant” icon. FTC accept complaints/reports about: Identity Theft, Do Not Call Registry violations, Internet and online privacy, Telemarketing scams. Credit scams, Immigration services, Sweepstakes, and prizes, Business opportunities schemes, Health and weight loss products, Debt collection, credit reports, and financial issues.

- On Social Media – Almost all major corporations will have a Twitter page or Facebook page where users can submit complaints, opinions or questions. Be aware that heavily critical comments may be removed by the company.

Choose a Company.

Alphabetical listing. Click on a letter.

A

- AAA Cooper Transportation Headquarters

- AARP Headquarters

- ABCOLISTS.COM Headquarters

- ABC Nissan Headquarters

- Abercrombie & Fitch Headquarters

- ABF Freight System Inc Headquarters

- Abitibi-Consolidated Headquarters

- Ace Hardware Distribution Ctr Headquarters

- Ace Hardware Headquarters

- Acosta Sales & Marketing Headquarters

- Action Performance Co Inc Headquarters

- Actronix Inc Headquarters

- Acxiom Corp Headquarters

- Addison Shoe Co Headquarters

- Adesa Birmingham Headquarters

- Adidas Headquarters

- Adobeair Inc Headquarters

- Adtran Inc Headquarters

- ADT Security Headquarters

- Aeci Headquarters

- Aerial Bouquets Inc Headquarters

- Aerojet Headquarters

- Aeropostale Headquarters

- AERT Headquarters

- Affiliated Foods Southwest Headquarters

- Agrium-Kenai Nitrogen Headquarters

- Airtex Products Headquarters

- Air System Components LP Headquarters

- Air Transport Intl Ltd Lblty Headquarters

- Alabama Electric Coop Inc Headquarters

- Alabama Farmers Co-Op Headquarters

- Alabama Gas Corporation Headquarters

- Alabama Metal Industries Corp Headquarters

- Alabama National Bancorp Headquarters

- Alabama Pine Pulp Company Inc Headquarters

- Alabama Power Company Headquarters

- Alabama Shipyard Headquarters

- Alaska General Seafoods Headquarters

- Alaska Sales & Svc Headquarters

- Albemarle Corp Headquarters

- Albertsons Headquarters

- Albertville Quality Foods Headquarters

- Alcoa Headquarters

- Alfa Corp Headquarters

- Aliant National Corp Headquarters

- Allegro Headquarters

- Allen Canning Co Headquarters

- Allen Engineering Corp Headquarters

- Alliance Bev Distrg Co LLC Headquarters

- Allied Tube & Conduit Headquarters

- Allied Waste Industries Inc Headquarters

- Allied Waste North America Headquarters

- Allstate Insurance Headquarters

- Alltel Corp Headquarters

- Almar Housekeepers Inc Headquarters

- Alpha Enterprises Inc-Tucson Headquarters

- Alpha Pro Tech Headquarters

- Altec Industries Inc Headquarters

- Alyeska Pipeline Svc Co Headquarters

- Amazon Headquarters

- Amedistaf Headquarters

- American Airlines Headquarters

- American Buildings Co Headquarters

- American Building Maintenance Headquarters

- American Cast Iron Pipe Co Headquarters

- American Express Company Headquarters

- American Fence & Security Headquarters

- American Flow Control Headquarters

- American Greetings Headquarters

- American International Group Headquarters

- American Railcar Industries Headquarters

- American State Bank Corp Headquarters

- Americas Mining Corporation Headquarters

- America West Airlines Inc Headquarters

- America West Holdings Corp Headquarters

- America’s Car-Mart Inc Headquarters

- Ameri Source Bergen Corp Headquarters

- Ameri Source Co Headquarters

- Amico Headquarters

- Ampac Pire Pros Headquarters

- Amtrak Headquarters

- AM South Bancorporation Headquarters

- ANB Bancshares Inc Headquarters

- Anchorage Cold Storage Odom Co Headquarters

- Anchor Packaging Headquarters

- Anderson News Co Phoenix Headquarters

- Anthony Forest Products Co Headquarters

- AOL Headquarters

- Apache Station Power Plant Headquarters

- APOLLO PRESS DIVISION Headquarters

- AppleBee’s Headquarters

- Apple Headquarters

- Applied Vertical System Headquarters

- Aps Group Headquarters

- Arby’s Headquarters

- Arch Chemicals Inc Headquarters

- Arctic Slope Regional Corp Headquarters

- Arizona Bus Ctr Headquarters

- Arizona Electric Power Co-Op Headquarters

- Arizona Medical Clinic LTD Headquarters

- Arizona Portland Cement Co Headquarters

- Arizona Public Svc Co Headquarters

- Arizona Republic Headquarters

- Arizona Wholesale Lbr & Supply Headquarters

- Arkansas Best Corp Headquarters

- Arkansas Blue Cross & Blue Headquarters

- Arkansas Children’s Hospital Headquarters

- Arkansas Democrat Gazette Headquarters

- Arkansas Electric Co-Op Corp Headquarters

- Arkansas Heart Hospital Headquarters

- Arkansas Nuclear 1 Headquarters

- Arkansas Western Gas Company Headquarters

- Arkups Headquarters

- Ark Aluminum Alloys Inc Headquarters

- Arquest Inc Headquarters

- Arrow Electronics Inc Headquarters

- Arvest Bank Fayetteville Headquarters

- Arvest Bank Group Inc Headquarters

- Arvest Bank Headquarters

- Arvest Bank-Bentonville Headquarters

- Asarco Inc Headquarters

- Asarco Ray Complex Headquarters

- Ashley Furniture Headquarters

- Ashton Co Inc Headquarters

- ASML North America Headquarters

- Asml US Inc Headquarters

- ASM Epitaxy Headquarters

- Asrc Energy Svc Headquarters

- Asrc Enrgy Svc Oprations Maint Headquarters

- Associated Grocers Inc Headquarters

- Atlas Copco Rental Svc Corp Headquarters

- AT&T Headquarters

- Auburn National Bancorporation Headquarters

- Auburn University Headquarters

- Audi Automobile Sales Headquarters

- Autozone Headquarters

- Auto Investment Inc Headquarters

- Auto Nation Dodge Headquarters

- Aviagen Inc Headquarters

- Avis Budget Headquarters

- Avnet Technology Solutions Headquarters

- Avocent Corp Headquarters

- Avondale Dodge & Suzuki Headquarters

- Avondale Mills Inc Headquarters

- Avondale Mitsubishi/Suzuki Headquarters

- Avondale Toyota Headquarters

- Aware Security Headquarters

- Aztar Corp Headquarters

- Azz Headquarters

- Az Medical Clinic Headquarters

- A W Domtar Corp Headquarters

B

- Baldor Electric Co Headquarters

- Baldor Motors and Drive Headquarters

- Baldwin County Board Education Headquarters

- Baldwin County EMC Headquarters

- Bale Chevrolet Headquarters

- Ball Metal Food Container Headquarters

- Bancshares Of Fayetteville Inc Headquarters

- Banc Corp Headquarters

- Banc Trust Financial Group Inc Headquarters

- Bandera Headquarters

- Bank First Headquarters

- Bank Independent Inc Headquarters

- Bank of America Headquarters

- Bank Of The Ozarks Inc Headquarters

- Bank of Tucson Headquarters

- Banner Baywood Medical Ctr Headquarters

- Banner Desert Medical Ctr Headquarters

- Banner Health Arizona Headquarters

- Banner Mesa Medical Ctr Headquarters

- Banner Thunderbird Headquarters

- Baptist Health Headquarters

- Baptist Health System Inc Headquarters

- Baptist Medical Ctr Headquarters

- Baptist Medical Ctr Montclair Headquarters

- Baptist Memorial Medical Ctr Headquarters

- Baptist South Headquarters

- Barnes & Noble Headquarters

- Barrow Neurological Institute Headquarters

- Bar-S Foods Co Headquarters

- Bashas’ Markets Inc Headquarters

- Basshas Distribution Ctr Headquarters

- Baxter Healthcare Headquarters

- Baxter Regional Medical Ctr Headquarters

- Bay By The Voyager Resort Headquarters

- Bear Distribution Headquarters

- BEAUDRY ACURA Headquarters

- Beaudry Motor Co Headquarters

- Beaudry RV Co Headquarters

- Beaulieu Fabrics Headquarters

- Beaulieu Of America Inc Headquarters

- Belk Incorporated Headquarters

- Bell Ford Headquarters

- Bell Road Suzuki Headquarters

- Bender Shipbuilding & Repair Headquarters

- Ben E Keith Co Headquarters

- Berge Ford Headquarters

- Bermco Aluminum Headquarters

- Best Buy Headquarters

- Best Motors Headquarters

- Best Software Inc Headquarters

- Best Western Intl Inc Headquarters

- Beverly Enterprises Inc Headquarters

- Big Lots Headquarters

- Big Springs Inc Headquarters

- Big Two Scion Headquarters

- Big Two Toyota Headquarters

- Bill Hard Chvrlet Inc-Hntsvlle Headquarters

- Bill Heard Chevrolet Headquarters

- Bill Penney Toyota Headquarters

- Bionova Holding Corp Headquarters

- Birch Communications Headquarters

- Birmingham Public Works Headquarters

- BIRMINGHAM Va Medical Ctr Headquarters

- BLharbert Holdings LLC Headquarters

- Blockbuster Headquarters

- Blood Systems Inc Headquarters

- Bloomingdale’s Inc. Headquarters

- Blue Bell Creameries Headquarters

- Blue Cross & Blue Shield Headquarters

- Blue Cross & Blue Shield Of Az Headquarters

- Blue Cross/Blue Shield BCBSAL Headquarters

- Blue Springs Hatchery Headquarters

- BMW North Scottsdale Headquarters

- BMW of North America, LLC Headquarters

- Board of Education City of Headquarters

- Board of Trustees Univ Ala Headquarters

- Boar’s Head Provisions Headquarters

- Boeing Co Headquarters

- Boise Cascade Corp Headquarters

- Books-A-Million Inc Headquarters

- Border Construction Specs Headquarters

- Boswell Memorial Hospital Headquarters

- Boyd Brothers Transportation Headquarters

- BPB America Inc Headquarters

- BP Chemical Co Headquarters

- BP Exploration Alaska Inc Headquarters

- BP Oil Headquarters

- Brasfield & Gorrie LLC Headquarters

- Brice Building Company Inc Headquarters

- Bridgestone Americas, Inc. Headquarters

- Bridgestone Multimedia Group Headquarters

- Briggs & Stratton Corp Headquarters

- Brookwood Medical Ctr Headquarters

- Brown & Brown Chevrolet Headquarters

- Brown & Brown Nissan Headquarters

- Bruce Oakley Inc Headquarters

- Bruno’s Supermarkets Inc Headquarters

- Bryce Corp Headquarters

- Bryce Corp Plant 5 Headquarters

- Buffalo Wild Wings Headquarters

- Builders Material Co Headquarters

- Burford’s Wood Waste Recycling Headquarters

- Burger King Headquarters

- Burke Jim Buick Headquarters

- Busbee Mobile Homes Headquarters

- B E & K Inc Headquarters

- B L Harbert Intl LLC Headquarters

- B N S F Logistics LLC Headquarters

- B P Exploration (alaska) Inc Headquarters

- B X Exchange Manager Headquarters

C

- Cabela’s Incorporated Headquarters

- Cablevision Systems Corporation Headquarters

- Cable News Network Headquarters

- Cable One Inc Headquarters

- Caddell Construction Co Inc Headquarters

- Cagle’s Inc Headquarters

- Camber Corporation Headquarters

- Camelback Toyota & Scion Headquarters

- Cameron Valves & Measurement Headquarters

- Candlewick Yarns Headquarters

- Canon U.S.A Inc. Headquarters

- Capital Lumber Company Headquarters

- Capital One Auto Finance Inc Headquarters

- Capital One Headquarters

- Capital Title Group Inc Headquarters

- Capitol Chevrolet Inc Headquarters

- Cargill Inc Headquarters

- Carlton-Bates Co Headquarters

- CARL T Hayden Va Medical Ctr Headquarters

- CarMax Inc. Headquarters

- Carondelet St Mary’s Hospital Headquarters

- Carraway Methodist Medical Ctr Headquarters

- Carraway Physicians Headquarters

- Casino Arizona Headquarters

- CAS Inc Headquarters

- Cavalier Homes Inc Headquarters

- Cavalier Homes Of Alabama Inc Headquarters

- Cavalry Portfolio Svc Headquarters

- Cavco Industries Inc Headquarters

- CBS Banc Corp Inc Headquarters

- Cbs Outdoor Headquarters

- Cdi Contractors LLC Headquarters

- Central Moloney Inc Headquarters

- CENTRIA Headquarters

- Century Bmw Headquarters

- Century Tube Headquarters

- Cenveo Inc Headquarters

- Cerrowire.com Headquarters

- Cerro Wire & Cable Co Headquarters

- Champion Homes Headquarters

- Chandler Homes Headquarters

- Chandler Regional Hospital Headquarters

- Chapman Automotive Group LLC Headquarters

- Chapman Chevrolet Geo Isuzu Headquarters

- Chapman Chevrolet-Isuzu Headquarters

- Chapman Scottsdale Autoplex Headquarters

- Charleston Hosiery Inc Headquarters

- Charter Funding Headquarters

- Chase Bankcard Services Inc Headquarters

- Chas Roberts AC Inc Headquarters

- Cheddars Headquarters

- Chemtura Headquarters

- Chevrolet Authorized Agency Headquarters

- Chick’n Quick Headquarters

- Chick-fil-A Headquarters

- Childrens Hospital Headquarters

- Chrysler Group LLC Headquarters

- Chugach Alaska Corporation Headquarters

- Chugach Electric Assn Inc Headquarters

- Church’s Chicken Headquarters

- Ciba Specialty Chemicals Headquarters

- CIGNA Co Headquarters

- Cigna Headquarters

- Cinram Corp Headquarters

- Circle K Headquarters

- Circle K Stores Inc Headquarters

- Citation Corp Headquarters

- Citigroup Inc. Headquarters

- Citizens Bancshares Headquarters

- Citizen’s Bank Headquarters

- City Meat Alliant Foodservice Headquarters

- City Wholeslae Grocery Company Headquarters

- CIT Headquarters

- Climax Molybdenum Company Headquarters

- Club Builders Inc Headquarters

- CNA National Warranty Corp Headquarters

- Coach, Inc. Headquarters

- Cobb-Vantress Inc Headquarters

- Coca-Cola Bottling Co Headquarters

- Coca-Cola Headquarters

- Cold Stone Creamery Inc Headquarters

- Coleman American Companies Headquarters

- Coleman/Cci Wire & Cable Co Headquarters

- Colonial Banc Group Inc Headquarters

- Colonial Company Headquarters

- Colonial Properties Trust Headquarters

- Comcast Cable Communications, LLC Headquarters

- Comcast Headquarters

- Commercial Cswork Installation Headquarters

- Community Bancshares Inc Headquarters

- Community Bank Headquarters

- Compass Bancshares Inc Headquarters

- Compensation Fund Ariz State Headquarters

- Computer Sciences Corp Headquarters

- Conair Corp Headquarters

- CONNECTING PUNCH Headquarters

- Conocophilips Company Headquarters

- Consolidated Pipe & Supply Inc Headquarters

- Continental Airlines Headquarters

- Continental Conveyor & Eqp Co Headquarters

- Continental Express Headquarters

- Continental Global Group Headquarters

- Continental Homes Headquarters

- Continental Homes Holding Corp Headquarters

- Con Agra Foods Inc Headquarters

- Con Agra Frozen Foods Headquarters

- Cooper Cameron Valves Headquarters

- Cooper Clinic Headquarters

- Cooper Standard Automotive Inc Headquarters

- Cooper Tire & Rubber Co Headquarters

- Coorstek Headquarters

- Copart Salvage Auto Auctions Headquarters

- Copper River Seafoods Headquarters

- Costco Headquarters

- Costco Warehouse Headquarters

- Coulter Cadillac Headquarters

- Coulter Motor Co Headquarters

- Courtesy Chevrolet Headquarters

- Courtesy On Bell Headquarters

- Coury Buick Pontiac GMC Truck Headquarters

- Cox Cable Phoenix Headquarters

- Cox Cable TV Headquarters

- Cox Communications, Inc. Headquarters

- Co-Sales Co Headquarters

- Creative Foods LLC Headquarters

- Crescent Crown Distributing Headquarters

- Cricket Communications, Inc. Headquarters

- Crossland Construction Co Headquarters

- CROSSMARK Headquarters

- Crosstown Traders Inc Headquarters

- Cross Oil & Refinery Headquarters

- Crown Infiniti Headquarters

- Crow-Burlingame Co Headquarters

- Crystal Lake Foods LLC Headquarters

- CSK Auto Corp Headquarters

- Custom-Pak Headquarters

- CVS Pharmacy Headquarters

D

- Daikin America Inc Headquarters

- Dairy Fresh of Al LLC Headquarters

- Dana Corp Headquarters

- Dan Schwartz Realty Inc Headquarters

- Darling Store Fixtures Headquarters

- Dassault Falcon Jet Corp Headquarters

- Davis Selected Advisers LP Headquarters

- Days Inn Worldwide, Inc. Headquarters

- DCH Regional Medical Center Headquarters

- Decatur General Headquarters

- Decatur Utilities Headquarters

- Degussa Corp Headquarters

- Dell Computer Headquarters

- Delphi Packard Electric Headquarters

- Delta Airlines Headquarters

- Delta Dental Plan of Arkansas Headquarters

- Deltic Timber Corp Headquarters

- Deluxe Video Svc Inc Headquarters

- Del E WEBB Memorial Hospital Headquarters

- Denny’s Headquarters

- Dependable Home Health Inc Headquarters

- Desert Diamond Banquet Dept Headquarters

- Desert Plastics Headquarters

- Desert Schools Federal Cr Un Headquarters

- Desert Toyota Headquarters

- Designer Skin Headquarters

- De Wafelbakkers Headquarters

- DHL Express (USA), Inc. Headquarters

- Dial Corp Headquarters

- Diamond International Trucks Headquarters

- Dick’s Sporting Goods Headquarters

- Dillard Travel Inc Headquarters

- Dillard’s Inc Headquarters

- Direct Alliance Corp Headquarters

- Discount Food Mart Headquarters

- Discount Tire Inc Headquarters

- Discover Financial Services Headquarters

- Dish Network Headquarters

- Disney Headquarters

- Dmccb Headquarters

- DMD Industries Headquarters

- Dohmen Distribution Prtnrs SE Headquarters

- Dollar General Headquarters

- Dollar Tree Headquarters

- Dominos Pizza Headquarters

- Domtar Industries Inc Headquarters

- Donaldson Co Headquarters

- Donovan Chrysler Plymouth Headquarters

- Don Sanderson Ford Inc Headquarters

- Douglas Products Headquarters

- Doyon Limited Headquarters

- Drivetime Automotive Group Inc Headquarters

- Dropbox Headquarters

- Drummond Co Inc Headquarters

- Dunkin Donuts Headquarters

- Dunn Investment Co Inc Headquarters

- Dynetics Inc Headquarters

E

- Eagle Picher Holdings Inc Headquarters

- Eagle Produce LTD Partnership Headquarters

- Eagle Produce Shop Headquarters

- Eagle Roofing Products Headquarters

- Eagle-Picher Holdings Inc Headquarters

- Earnhardts Ford Headquarters

- Earnhardt Chrysler Jeep Headquarters

- Earnhardt Ford Headquarters

- Earnhardt Headquarters

- Earnhardt’s Chandler Mazda Headquarters

- Earnhardt’s Chrysler Jeep Headquarters

- Earthgrains Co Headquarters

- Earthlink, Inc. Headquarters

- Eastern Health System Inc Headquarters

- Eastman Chemical Co Headquarters

- East Alabama Medical Center Headquarters

- East Alabama Medical Ctr Headquarters

- East Valley/Scottsdale Tribune Headquarters

- Eaton Corp Headquarters

- eBay, Inc. Headquarters

- EBCO Inc Headquarters

- Ecm Headquarters

- Ed Moses Dodge Inc Headquarters

- Electrolux Home Products Headquarters

- Elite Lamp Inc Headquarters

- Eliza Coffee Memorial Hospital Headquarters

- Emerson Electric Co Headquarters

- Empire Hydraulic Svc Headquarters

- Empire Machinery Headquarters

- Empire Power Systems Headquarters

- Empire Southwest LLC Headquarters

- Energen Corp Headquarters

- Energy South Inc Headquarters

- Entergy Arkansas Inc Headquarters

- Entergy Corp Headquarters

- Enterprise Headquarters

- Equity Group Eufaula Div LLC Headquarters

- ERA Aviation Inc Headquarters

- ESPN, Inc. Headquarters

- Eurofresh Inc Headquarters

- Evergreen Lawn Sprinklers Headquarters

- Ewing Irrigation Products Headquarters

- Excell Agent Svc Headquarters

- Excel DPM Of Arkansas Inc Headquarters

- Exxon Mobil Corp Headquarters

- EZ Pass New York Headquarters

- E Funds Corp Headquarters

F

- Facebook Headquarters

- Facebook Phone Number Search

- Fairbanks Memorial Hospital Headquarters

- Family Dollar Headquarters

- Family Dollar Store Headquarters

- Fandango Inc. Headquarters

- Farley Nuclear Plant Headquarters

- Farmers Insurance Group Headquarters

- Farmer’s Insurance Headquarters

- Federal Coach Headquarters

- Federal Coach LLC Headquarters

- Federal Mogul Headquarters

- Fedex Freight East Inc Headquarters

- Fedex Headquarters

- FedEx Office and Print Services, Inc. Headquarters

- Fed Ex Freight East Inc Headquarters

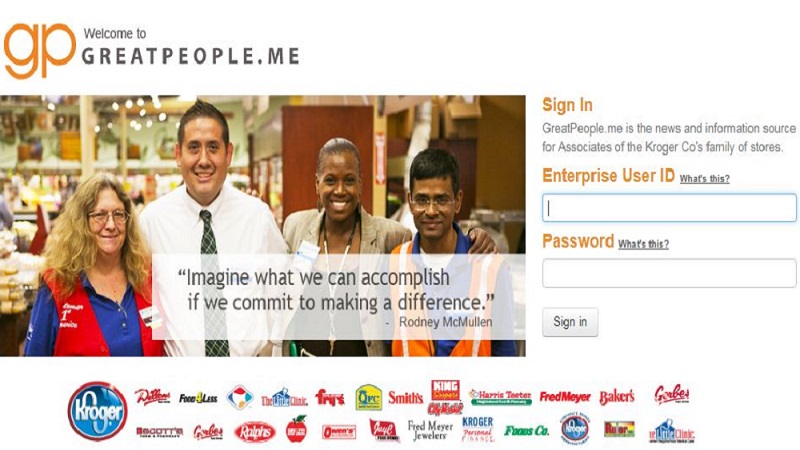

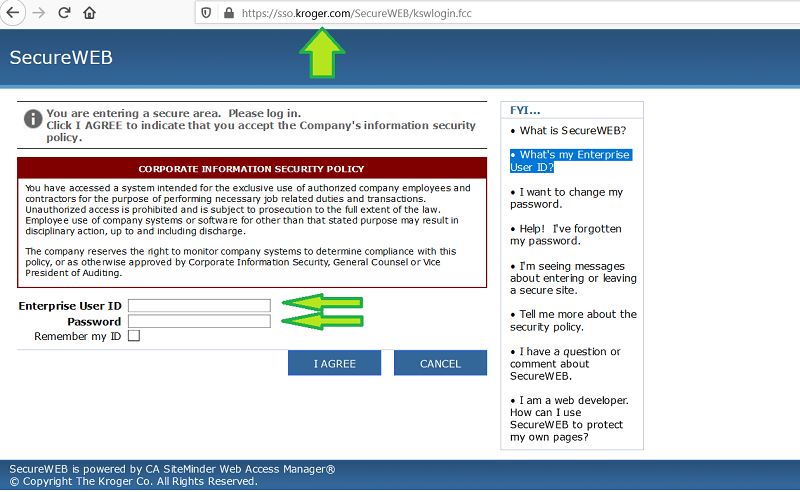

- Feed Kroger ESS eSchedule Login

- Fender Musical Instruments Headquarters

- Ferguson Headquarters

- Fidelity Information Svcs Inc Headquarters

- Finova Capital Corporation Headquarters

- Finova Group Inc Headquarters

- Firestone Building Products Co Headquarters

- Fireworks Productions-Az LTD Headquarters

- First Bank Corp Headquarters

- First Commercial Bank Headquarters

- First Electric Coop Corp Headquarters

- First Federal BANCSHARES Of Ar Headquarters

- First Financial Bank-El Dorado Headquarters

- First Health Group Corp Headquarters

- First Magnus Financial Corp Headquarters

- First National Bank Alaska Headquarters

- First National Bank Headquarters

- First National Bank Of Jasper Headquarters

- First Security Bancorp Headquarters

- First State Bank Headquarters

- Flash Market Inc Headquarters

- Flint Hills Resources Headquarters

- Flipchip International Headquarters

- Flowers Baking Co Headquarters

- Flowers Hospital Headquarters

- FNS Bancshares Inc Headquarters

- Fontaine Industries Inc Headquarters

- Fontaine International Inc Headquarters

- Foodland Albertville Headquarters

- Food Network Headquarters

- Food Services Of America Headquarters

- Food World Headquarters

- Ford Motor Company Headquarters

- Ford-North Scottsdale Cllsn Headquarters

- Forever Living Products US Headquarters

- Forever 21 Headquarters

- Forrest City Grocery Co Headquarters

- Fort Defiance PHS Headquarters

- Fort Mc Dowell Casino Headquarters

- Fosgate Audionics Headquarters

- Fountains The Headquarters

- Fox News Network, LLC Headquarters

- Franklin Electric Co Inc Headquarters

- Freightliner Arizona Headquarters

- Freightliner Headquarters

- Friendly Ford Lincoln Mercury Headquarters

- Frontier Airlines Headquarters

- Frontier National Corp Headquarters

- Frontier Yarns Headquarters

- Frys Food Stores Headquarters

- Fuji Film Headquarters

- Fulton Homes Sales Headquarters

- F C Business Systems Headquarters

G

- Gadsden Regional Medical Ctr Headquarters

- GameStop Headquarters

- Gates Corp Headquarters

- Gates Rubber Co Headquarters

- Gateway, Inc. Headquarters

- GCI Communication Corp Headquarters

- Geico Headquarters

- General Cable Headquarters

- General Communication Inc Headquarters

- General Electric Company Headquarters

- General Motors Headquarters

- Gen Corp Headquarters

- George’s Inc Headquarters

- George’s Processing Headquarters

- Georgia Pacific-Dixie Products Headquarters

- Georgia-Pacific Corp Headquarters

- Georgia-Pacific Plywood Headquarters

- Georgia-Pacific Resins Inc Headquarters

- Gerber Products Company Headquarters

- Gerber Products Co Headquarters

- GE Co Headquarters

- Giant Eagle, Inc. Headquarters

- Giant Industries Inc Headquarters

- Giant Service Stations Headquarters

- Gm Desert Proving Grounds Headquarters

- GNC Holdings, Inc. Headquarters

- Golden Flake Snack Foods Inc Headquarters

- Golden Peanut Co Headquarters

- Golden State Foods Corp Headquarters

- Gold KIST Inc Headquarters

- Gold’s Gym International, Inc. Headquarters

- Goodrich BF Aircraft Interior Headquarters

- Goodrich Corp Headquarters

- Goodyear Rubber & Tire Headquarters

- Goodyear Tire & Rubber Co Headquarters

- Good Samaritan Medical Ctr Headquarters

- Google Inc. Headquarters

- Grandma LA Mures Spice-N-Slice Headquarters

- Graybar Electric Co Headquarters

- Great Clips, Inc. Headquarters

- Great Dane Trailers Headquarters

- Great Lakes Chemical Corp Headquarters

- Greyhound Lines, Inc. Headquarters

- Groupon, Inc. Headquarters

- Guardian Fiberglass Headquarters

- Gulf States Paper Corp Headquarters

H

- Hamilton Aerospace Tech Inc Headquarters

- Harold Gwatney Chevrolet Co Headquarters

- Harps Food Stores Headquarters

- Harp’s Food Stores Inc Headquarters

- Head/Penn Racquet Sports Headquarters

- Healthsouth Corp Headquarters

- HealthSouth Headquarters

- Healthsouth/Uab Gamma Knife Headquarters

- Health Advantage Headquarters

- Health Net of Arizona Inc Headquarters

- Heil Co Headquarters

- Henry Brown Buick Pontiac GMC Headquarters

- Hensley and Company Wholesale Headquarters

- Hensley Beer Headquarters

- Hensley & Co Headquarters

- Heritage Financial Holding Headquarters

- Hertz Headquarters

- Hibbett Sporting Goods Inc Headquarters

- Hibbett Sports Headquarters

- Hickory Springs Mfg Co Headquarters

- Highway Dept Headquarters

- Hl-A Company Inc Headquarters

- Hoffinger Industry Inc Headquarters

- Holmes Tuttle Ford Headquarters

- Holsum Bakery Inc Headquarters

- Holt-Krock Clinic Headquarters

- Home Banc Shares Inc Headquarters

- Home Depot Headquarters

- Honda Manufacturing Ala L L C Headquarters

- Honda Motor Company Headquarters

- Honeywell Aerospace Headquarters

- Honeywell Engines Headquarters

- Hoover City Schools Headquarters

- Hoover Toyota LLC Headquarters

- Horizon Headquarters

- House Of Threads Headquarters

- Houston’s Restaurant Inc Headquarters

- How To Call In Sick At Walmart (Walmart’s Call Out Sick Number)

- HSBC North America Holdings, Inc. Headquarters

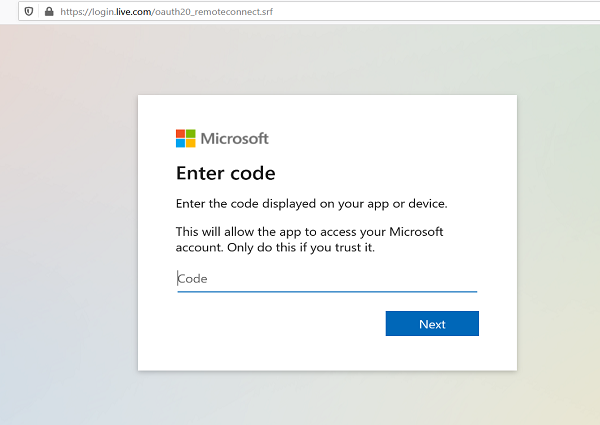

- //aka.ms/remoteconnect

- Huck Aerospace Headquarters

- Hughes Supply Headquarters

- Hulu LLC Headquarters

- Huntsville City Schools Headquarters

- Huntsville Hospital Headquarters

- Hunt Corporation Headquarters

- Hydro Aluminum Headquarters

- Hydro Aluminum North America Headquarters

- Hypercom Corp Headquarters

- HYPERCOM NETWORK SYSTEMS Headquarters

- Hytrol-Medical Clinic Headquarters

- Hyundai USA Headquarters

I

- Imageworks Headquarters

- IMERYS Headquarters

- Impero Natural Stone Group Headquarters

- Im Acquisitions Inc Headquarters

- Infiniti Of Scottsdale Headquarters

- Infinity Property & Casualty Headquarters

- Insight Direct Usa Inc Headquarters

- Insight Enterprises Inc Headquarters

- Instagram Headquarters

- Institute For Pro Development Headquarters

- Integrated Defense Tech Headquarters

- Integrated Stucco Headquarters

- Integrated Systems Management Headquarters

- Intellimark Holdings Inc Headquarters

- Intel Corp Headquarters

- Intergraph Corp Headquarters

- INTERGRAPH GOVERNMENT SOLUTION Headquarters

- International Paper Co Headquarters

- Inter-Tel Incorporated Headquarters

- Inter-Tel Inc Headquarters

- Inter-Tel Intgrted Systems Inc Headquarters

- INTESYS Technologies Inc Headquarters

- IPSCO Tubulars Inc Headquarters

- Itss Group Headquarters

- ITT Corporation Headquarters

- ITT Industries Inc Headquarters

J

- Jackson Hospital Headquarters

- Jack in the Box Headquarters

- JCPenney Associate Kiosk – JCP Kiosk Login

- JDA Software Group Inc Headquarters

- Jefferson County Board Educatn Headquarters

- Jefferson County Health Dept Headquarters

- JEFFERSON REGIONAL MEDICAL CEN Headquarters

- JEFFERSON Regional Medical Ctr Headquarters

- JetBlue Airways Headquarters

- Jiffy Lube International, Inc. Headquarters

- Jim Click Dodge Headquarters

- Jim Click Ford Headquarters

- Jim Click Lincoln-Mercury Headquarters

- Jim Click Nissan Headquarters

- Jim Skinner Ford Headquarters

- Jim Walter Resources Inc Headquarters

- Johnson Sea Products Inc Headquarters

- John C Lincoln Hospital Headquarters

- Jo-Ann Stores, Inc. Headquarters

- JP Morgan Chase & Co. Headquarters

- J A Riggs Tractor Co Headquarters

- J B Hunt Transport Inc Headquarters

- J B Hunt Transport Services Headquarters

- J V C America Inc Headquarters

- J. C. Penney Corporation, Inc. Headquarters

K

- KASW Headquarters

- Kawneer Co Headquarters

- Kemlite Co Headquarters

- Kenai Pipeline Co Headquarters

- Kimberly-Clark Headquarters

- Kirklin Clinic Headquarters

- Kitchell Corporation Headquarters

- Knauf Fiber Glass Headquarters

- Knight Transportation Inc Headquarters

- Knipp Brothers Industries LLC Headquarters

- Kodiak Salmon Packers Headquarters

- Kohler Co Faucet Operations Headquarters

- Kohls Headquarters

- Konica MINOLTA Ptg Solutions Headquarters

- Konica Mnlta Prtg Slutions USA Headquarters

- Kragen Auto Parts Headquarters

- Kroger Express HR Paystub Login

- Kroger Headquarters

- KSAZ-Fox Ten Headquarters

- Kwajalein Range Services LLC Headquarters

- K & L Advertising Headquarters

L

- Laboratory Corp Of America Headquarters

- Lake Powell Boat Tours Headquarters

- Landers Ford Headquarters

- Land O’ Frost Inc Headquarters

- Larry Miller Toyota Scion Headquarters

- LATCO Inc Headquarters

- LA Barge Inc Headquarters

- LA Canasta Mexican Food Prods Headquarters

- LA Fitness Headquarters

- LA Forage North America Headquarters

- LA-Z-Boy Headquarters

- Learjet Inc Headquarters

- Leavy Restaurants-America West Headquarters

- Lee Apparel Distribution Ctr Headquarters

- Legends Furniture Headquarters

- Legion Field Stadium Headquarters

- Leisure Arts Inc Headquarters

- Lennox Industries Headquarters

- Leslies Poolmart Inc Headquarters

- Levy Restaurants Headquarters

- Lewis Automotive Group Used Headquarters

- Lg Electronics Alabama Inc Headquarters

- Lg Electronics USA Headquarters

- Liberty Bancshares Inc Headquarters

- Liberty Bank Of Arkansas Headquarters

- Liberty Mutual Holding Company, Inc. Headquarters

- Limited Brands Aces ETM

- Lion Oil Co Headquarters

- LiteBlue USPS Login

- Little Rock Public Schools Headquarters

- Livingston Box Inc Headquarters

- Living Social Headquarters

- Lockheed Martin Corp Headquarters

- Lockheed Martin Space Systems Headquarters

- Lomanco Inc Headquarters

- Londen Insurance Group Inc Headquarters

- Louisiana-Pacific Corp Headquarters

- Lou Grubb Chevrolet Headquarters

- Lou Grubb Dodge Headquarters

- Lou Grubb Ford Headquarters

- Lowes Headquarters

- Lucent Technologies Headquarters

- Lund Cadillac Company Headquarters

- Lyft Headquarters

- L A Darling Co Headquarters

M

- Macsteel Headquarters

- Macys Headquarters

- Macys Insite

- Macys Insite Login

- Madison County Board Education Headquarters

- Main Street Restaurant Group Headquarters

- Maples Industries Inc Headquarters

- Marshall Durbin Companies Headquarters

- Marshall Medical Ctr Headquarters

- Masland Carpets Inc Headquarters

- Maverick Structural Plant Headquarters

- Maverick Transportation Inc Headquarters

- Maverick Tube Corporation Headquarters

- Maverick Tube Corp Headquarters

- Mayer Electric Supply Company Headquarters

- Mayo Clinic Hospital Headquarters

- Maytag Corp Headquarters

- Maytag Searcy Laundry Products Headquarters

- Mbc United Wholesale Headquarters

- McDonald’s Headquarters

- MCI Headquarters

- McLane/Sunwest Inc Headquarters

- McWane Coal Company Headquarters

- Mc Clinton Anchor Co Headquarters

- Mc Kee Foods Corp Headquarters

- Mc Kesson Specialty Headquarters

- Mc Lane Foodservice Headquarters

- Mc Lane Southeast Headquarters

- Mc Lane Sunwest Headquarters

- Mc Pherson Oil Products Headquarters

- Meadow Gold Dairies Headquarters

- Meadow Valley Corporation Headquarters

- Meadow Valley Corp Headquarters

- Mead Westvaco Coated Board Headquarters

- Medical Center East Inc Headquarters

- Medical College Physicians Grp Headquarters

- MEDICIS DERMATOLOGICS Headquarters

- Medicis Pharmaceutical Corp Headquarters

- Medtronic Microelectronics Ctr Headquarters

- Medtronic Micro Rel Headquarters

- Menards

- Meow Mix Co Headquarters

- Mercedes-Benz USA, Inc. Headquarters

- Mercedes-BENZ Us Intl Inc Headquarters

- Merchants Co Headquarters

- Meritage Homes Corp Headquarters

- Mesastaff Personnel Services Headquarters

- Mesa Airlines Headquarters

- Mesa Air Group Inc Headquarters

- Mesa Lutheran Hospital Headquarters

- Metals USA Headquarters

- Metro PCS Headquarters

- Mica Headquarters

- Michael Lewis Co W Headquarters

- Michelin Tire Corp Headquarters

- Microchip Technology Inc Headquarters

- Microsemi Corp/Scottsdale Div Headquarters

- Microsoft Headquarters

- Midstream Fuel Service Inc Headquarters

- Midway Buick Headquarters

- Midway Chevrolet Headquarters

- Midway Infiniti Headquarters

- Midway Nissan Inc Headquarters

- Midway PONTIAC-GMC-Buick Headquarters

- Mid-South Electronics Inc Headquarters

- Mid-South Industries Inc Headquarters

- Millbrook Distribution Svc Headquarters

- Miller Wholesale Lumber Co Headquarters

- Miltope Group Inc Headquarters

- Misys Healthcare Systems Headquarters

- Mitchell Grocery Corp Headquarters

- MITEK Corp Headquarters

- MlifeInsider Login

- Mobile County Health Dept Headquarters

- Mobile Infirmary Medical Ctr Headquarters

- Mobile Mini Inc Headquarters

- Molex Inc Headquarters

- Montgomery County School Dst Headquarters

- Montgomery Public Schools Headquarters

- Moore-Handley Inc Headquarters

- Motion Institute The Headquarters

- Motorola Headquarters

- Motorola Satellite Communications Headquarters

- Motorsports Authentics Inc Headquarters

- Mountain Country Supply Inc Headquarters

- Mountain Home Bancshares Inc Headquarters

- Mountain Valley Spring Co Inc Headquarters

- Mountaire Corporation Headquarters

- Movie Gallery Inc Headquarters

- MTA Headquarters

- Mt Graham Regional Medical Ctr Headquarters

- Murphy Oil Corp Headquarters

- Murphy Oil Usa Inc Headquarters

- Muscular Dystrophy Assn Headquarters

- Mutual of Omaha Insurance Company Headquarters

- MyHR CVS

- Myloweslife – Lowes Kronos

- Mynordstrom

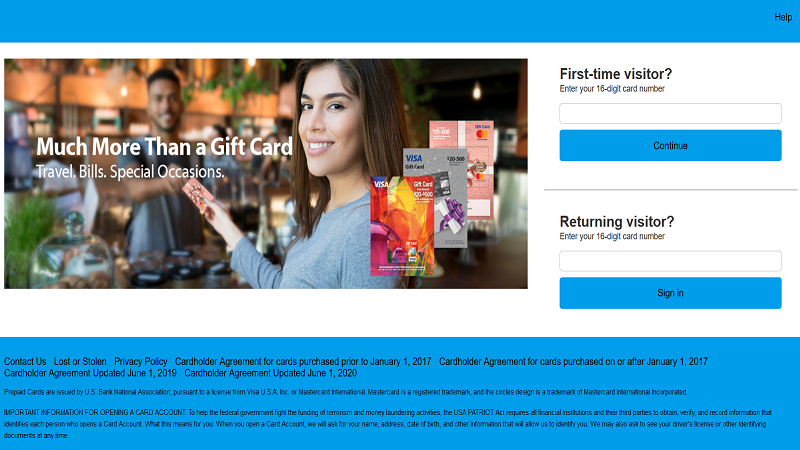

- Myprepaidcenter.com Activation and Balance Check

- MyTHDHR Your Schedule

- My Apron Home Depot ESS

N

- Nabholz Construction Corp Headquarters

- Nacco Materials Handling Group Headquarters

- Nana Regional Corporation Inc Headquarters

- National Bank of Arizona Headquarters

- National Linen Svc Headquarters

- NATIONAL LUMBER CO Headquarters

- National Optical Astronomy Headquarters

- Nationwide Mutual Insurance Company Headquarters

- Nautilus Insurance Company Headquarters

- Navajo Tribal Utility Auth Headquarters

- Nektar Therapeutics Corp Headquarters

- Nestle Purina Petcare Co Headquarters

- Netflix Headquarters

- Netsian Technologies Group Headquarters

- Neurological Physicians Headquarters

- Newspaper Holdings Headquarters

- New Vision Intl Headquarters

- New West Lending Inc Headquarters

- Next Student Headquarters

- Nex Tel Communications Headquarters

- Nicholas Homes Headquarters

- Nichols Aluminum Inc Headquarters

- Nike Headquarters

- Nissan North America, Inc. Headquarters

- Nissan Thoroughbred Headquarters

- Nordstrom Headquarters

- Norment Security Group Inc Headquarters

- Norshield Airteq Trentech Headquarters

- Northern Arizona Healthcare Headquarters

- Northern Arizona Homecare Headquarters

- Northern Pipeline Construction Headquarters

- Northpoint Forest Headquarters

- Northport Hospital Med Ctr Headquarters

- Northrim Bancorp Inc Headquarters

- Northrop Grumman Elect Systems Headquarters

- Northwest Medical Ctr Headquarters

- North Point Lincoln Mercury Headquarters

- North Star Communications Group Headquarters

- Nucor Steel Decator Headquarters

- Nucor Steel Tuscaloosa Inc Headquarters

- Nucor-Yamato Stl A Joint Ventr Headquarters

- Nuvell Financial Svc Group Headquarters

- N P L Headquarters

O

- Oaklawn Jockey Club Headquarters

- Ocean Beauty Seafoods Inc Headquarters

- Odom Co Headquarters

- Office Depot Headquarters

- Old Navy Headquarters

- Old Pueblo Traders Headquarters

- Olin Chlor Alkali Products Headquarters

- Olive Garden Headquarters

- ONeal Metals Inc Headquarters

- Oneal Steel Inc Headquarters

- On Semiconductor Corp Headquarters

- On The Go Wireless Headquarters

- Opus West Corporation Headquarters

- Orbital Sciences Corp Headquarters

- Orbitz Headquarters

- Oreillys Auto Parts HQ (Oriellys)

- ORielly Motor Company Headquarters

- Oursainsburys – Mysainsburys

- Outback Steakhouse Headquarters

- Outdoor Systems Advertising Headquarters

- Owens-Illinois Plstc Food/Bvrg Headquarters

- Oxford Life Insurance Company Headquarters

- Ox Bodies Inc Headquarters

- O K Foods Inc Headquarters

- O K Industries Inc Headquarters

- O 2 Science Headquarters

- O’Rielly Chevrolet Headquarters

P

- Pace Industries Inc Headquarters

- Packaging Distribution System Headquarters

- PAM Transportation Svc Inc Headquarters

- Panasonic Headquarters

- Pandora Headquarters

- Panera Bread Headquarters

- Papa Johns Headquarters

- Parker-Hannifin Corp Headquarters

- Partlowe Developmental Ctr Headquarters

- Payless Shoes Headquarters

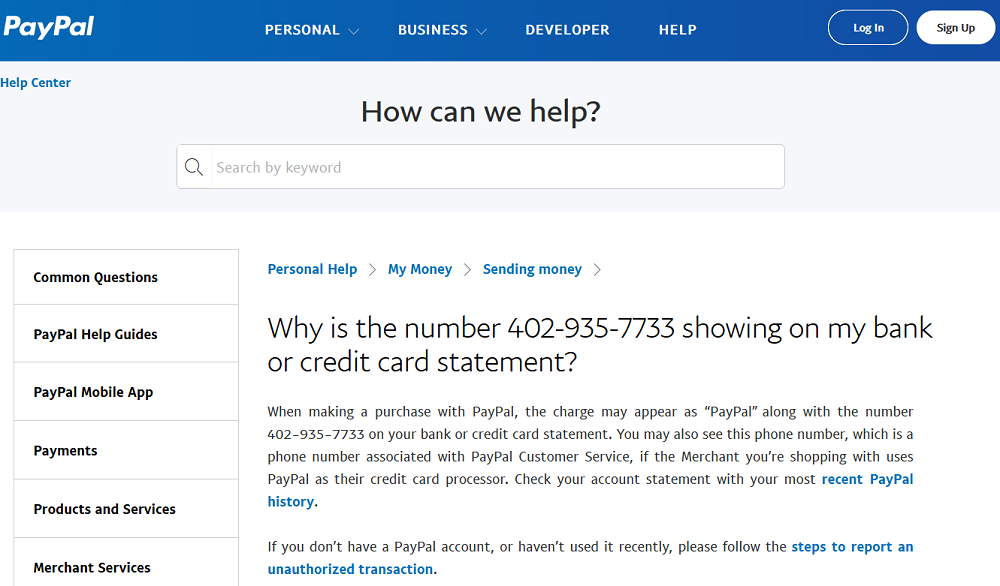

- Paypal Headquarters

- Peco Farms Inc Headquarters

- Peco Headquarters

- Pemco Aeroplex Inc Headquarters

- Pemco Aviation Group Inc Headquarters

- Peoples Banc Trust Co Inc Headquarters

- Pepper Source LTD Headquarters

- Pepsi Americas Inc Headquarters

- Pepsi-Cola Bottling Co Headquarters

- Pep Boys Headquarters

- Perdue Farms Inc Headquarters

- Performance Chrysler Jeep Headquarters

- Petco Headquarters

- Petit Jean Poultry Inc Headquarters

- Petro Star Inc Headquarters

- Petsmart Headquarters

- PFG-Quality Headquarters

- Phelps Dodge Bagdad Inc Headquarters

- Phelps Dodge Corporation Headquarters

- Phelps Dodge Miami Headquarters

- Phelps Dodge Miami Pinal Crk Headquarters

- Phelps Dodge Morenci Headquarters

- Phelps Dodge Sahuarita Mining Headquarters

- Phoenix Baptist Hosp & Med Ctr Headquarters

- Phoenix Cement Co Headquarters

- Phoenix Coca-Cola Bottling Co Headquarters

- Phoenix Fuel Co Inc Headquarters

- Phoenix Motor Co Headquarters

- Phoenix Sky Harbor Intl Airprt Headquarters

- Piggly Wiggly Ala Distrg Co Headquarters

- Pilgrim’s Pride Corp Headquarters

- PINE BLUFF FOUNDATION FUND Headquarters

- Pinnacle Bancshares Inc Headquarters

- Pinnacle Foods Corp Headquarters

- Pinnacle Nissan Headquarters

- Pinnacle West Capital Corp Headquarters

- Pioneer Ford Alternative Fuels Headquarters

- Pioneer Ford A United Auto Headquarters

- Pizza Hut Headquarters

- Plantation Patterns Headquarters

- Planters Lifesavers Co Headquarters

- Pocahontas Bancorp Inc Headquarters

- Pointe Hilton Squaw Peak Headquarters

- Polymer Group Inc Headquarters

- Popeyes Headquarters

- Poser Business Forms Inc Headquarters

- Potlatch Corp Headquarters

- Power Chevrolet Headquarters

- Power Nissan Headquarters

- Pratte Development Co Headquarters

- Precision Oracle Headquarters

- Preferred Homecare Headquarters

- Prewett Distribution Center Headquarters

- Priceline Headquarters

- Prime Industrial Headquarters

- Procter & Gamble Co Headquarters

- Producers Rice Mill Inc Headquarters

- Proffitts Headquarters

- Progress Rail Services Corp Headquarters

- Providence Ak Medical Ctr Headquarters

- Providence Hospital Headquarters

- Prudential Financial Headquarters

- Prudential Relocation Mgmt Headquarters

- Public Storage Headquarters

- Publix Headquarters

- Publix Passport

- Pulaski County Special School District Headquarters

- Pulaski Investment Corp Headquarters

- Pulte Homes Corp Headquarters

- P F Changs China Bistro Inc Headquarters

Q

R

- Ram Tool & Supply Co Inc Headquarters

- Randall Publishing Co Headquarters

- Ready Mix Usa Inc Headquarters

- Recreation Center Of Sun City Headquarters

- Redman Homes Inc Headquarters

- Redstone Federal Credit Union Headquarters

- Red Lobster Headquarters

- Red Mountain Residential Headquarters

- Regional Medical Ctr Headquarters

- Rehau Inc Headquarters

- Reliable Louvers Headquarters

- Remington Arms Co Headquarters

- Rent a Center Headquarters

- Republic Claims Insurance Headquarters

- Rheem Manufacturing Co Headquarters

- Riceland Foods Inc Headquarters

- Richmond American Headquarters

- Ricon Headquarters

- Riggs Hydraulic Center Headquarters

- Right Honda Headquarters

- Right Toyota Headquarters

- Rinker Materials Corp Headquarters

- Rite Aid Headquarters

- Riverside Furniture Corp Headquarters

- Riviera Utilities Headquarters

- Roadrunner Fire & Safety Equip Headquarters

- Robert Bosch Tool Corp Headquarters

- Robson Communities Inc Headquarters

- Rockford Corp Headquarters

- Rockford Fosgate Headquarters

- Rockline Industries Headquarters

- Rockline-Midwest Inc Headquarters

- Rock-Tenn Co Headquarters

- Rodger’s Custom Upholstery Headquarters

- Roofing Wholesale Co Inc Headquarters

- Rooms To Go Headquarters

- Ross Breeders Warehouse Headquarters

- Ross Stores Headquarters

- Royal Jaguar Headquarters

- Rugby Usa Inc Headquarters

- Rummel Construction Inc Headquarters

- Rural/Metro Corp Headquarters

- RUSSELL ATHLETIC DIVISION Headquarters

- Russell Chevrolet Honda Headquarters

- Russell Corp Headquarters

- Ryerson Tull Headquarters

- R L Zeigler Co Headquarters

S

- Saab Financial Svc Headquarters

- Saab Leasing Co Headquarters

- Safeguard Security & Comm Inc Headquarters

- Safeway, Inc. Headquarters

- Safe Ride Services Inc Headquarters

- Saint Edward Mercy Medical Ctr Headquarters

- Saint Josephs Mercy Health Ctr Headquarters

- Saint Marys Hospital Headquarters

- Salt River Project Headquarters

- Samsung Headquarters

- Samuel Lawrence Furniture Co Headquarters

- Sanderson Ford Headquarters

- Sanders Lead Co Inc Headquarters

- Sands Chevrolet Headquarters

- Sanmina-Sci Corp Headquarters

- Sanyo Manufacturing Corp Headquarters

- Sara Lee Bakery Group Inc Headquarters

- Sara Lee Hosiery Headquarters

- Sawyer’s Siding & Window Headquarters

- Schneider National Headquarters

- Schuck Component Systems Inc Headquarters

- Schuck Wholesale Lumber Headquarters

- Schueck Steel Headquarters

- Schuff International Inc Headquarters

- Schuff Steel Co Headquarters

- Science Applications Intl Corp Headquarters

- SCI Enclosures LLC Headquarters

- SCI Holdings Inc Headquarters

- Scottsdale Healthcare Osborn Headquarters

- Scottsdale Healthcare Shea Headquarters

- Scottsdale Insurance Company Headquarters

- Sealaska Corporation Headquarters

- Sears Headquarters

- Sears Roebuck & Co Headquarters

- Sea World Headquarters

- Shamrock Farms Dairy Headquarters

- Shamrock Foods Co Headquarters

- Shaw Industries Inc Headquarters

- Shelby Baptist Medical Ctr Headquarters

- Shelby County Board Education Headquarters

- Shell Chemical Co Headquarters

- Shell Oil Headquarters

- Showcase Honda Headquarters

- Showcase PONTIAC-GMC Mazda Headquarters

- Siemens VDO Automotive Headquarters

- Siemens VDO Auto Elec Corp Headquarters

- Sigler & Reeves Headquarters

- Simmons First Bank-Nw Arkansas Headquarters

- Simmons First National Corp Headquarters

- Simmons Foods Inc Headquarters

- Simplex Grinnell Headquarters

- Simply Fashions Headquarters

- Simula Inc Headquarters

- Six Flags Headquarters

- Skilstaf Inc Headquarters

- Smith Industries Inc Headquarters

- Smith & Wesson Holding Corp Headquarters

- Smith-Blair Inc Headquarters

- SMI Joist Headquarters

- Smurfit-Stone Container Corp Headquarters

- Solar Industries Headquarters

- Solutia Inc Headquarters

- Sonic Corp. Headquarters

- Sony Headquarters

- Sony Magnetic Products Inc Headquarters

- Southeast Alabama Gas District Headquarters

- Southeast Alabama Medical Ctr Headquarters

- Southern Aluminum Castings Co Headquarters

- Southern Bakeries Inc Headquarters

- Southern Bancorp Inc Headquarters

- Southern Energy Homes Inc Headquarters

- Southern Nuclear Operating Co Headquarters

- Southern Peru Copper Corp Headquarters

- Southern Wine & Spirits Headquarters

- Southland Racing Corp Headquarters

- Southwestern Energy Company Headquarters

- Southwest Airlines Headquarters

- Southwest Canning & Packaging Inc Headquarters

- Southwest Gas Headquarters

- Southwest Student Services Headquarters

- South Baldwin Regional Med Ctr Headquarters

- Sparks Medical Fndtn Headquarters

- Sparks Regional Medical Ctr Headquarters

- Spirit Airlines Headquarters

- Springhill Medical Ctr Headquarters

- Sprint Headquarters

- Stacy Williams Headquarters

- Staley Electric Headquarters

- Standard Furniture Mfg Co Headquarters

- Staples Headquarters

- Starbucks Headquarters

- State Farm Insurance Headquarters

- Stephens Group Inc Headquarters

- Stephens Inc Headquarters

- Stephen L Lafrance Holdings Headquarters

- Stock Yards Headquarters

- St Bernards Medical Ctr Headquarters

- St Bernards Regional Med Ctr Headquarters

- St Joseph’s Hospital Headquarters

- St Joseph’s Hospital & Med Ctr Headquarters

- St Joseph’s Mercy Health Ctr Headquarters

- St Luke’s Medical Ctr Headquarters

- St Vincents Hospital Headquarters

- St Vincent Health System Headquarters

- St Vincent Infirmary Medical Headquarters

- Subway Headquarters

- Summit Builders Cnstr Co Headquarters

- Suncoast Post Tension Headquarters

- Suncor Development Company Headquarters

- Sundt Construction Inc Headquarters

- Sunshine Feed Mills Inc Headquarters

- Suntron Corp Headquarters

- Sun Health Corp Headquarters

- Sun Land Beef Company Headquarters

- Superior Industries Intl Inc Headquarters

- Superlite Block Headquarters

- Superstition Springs Toyota Headquarters

- Superwall Manufacturing Headquarters

- Swift Transportation Co Inc Headquarters

- Sylvest Farms Inc Headquarters

- Syngenta Crop Protection Inc Headquarters

- Sysco Headquarters

T

- Taco Bell Headquarters

- Tanner Companies (yuma) Inc Headquarters

- Target EHR SSO – Target View My Schedule

- Target Headquarters

- Teledyne Brown Engineering Headquarters

- Teleflora Headquarters

- Telex Communications Inc Headquarters

- Tempe Dodge KIA Headquarters

- Tempe Toyota Parts Headquarters

- Temple-Inland Forest Products Headquarters

- Tenneco Automotive Headquarters

- Terra Nitrogen Corp Headquarters

- Tesoro Alaska Petroleum Co Headquarters

- Texas Foundries Headquarters

- Texas Instruments Headquarters

- TGI Friday’s Headquarters

- Thermasys Holding Company Headquarters

- THE CROWN GROUP Headquarters

- The Directv Group, Inc. Headquarters

- The Gap, Inc. Headquarters

- The Hearst Corporation Headquarters

- The Sherwin-Williams Company, Inc. Headquarters

- The Sundt Companies Inc Headquarters

- The Tech Group Headquarters

- The TJX Companies, Inc. Headquarters

- The Travelers Companies, Inc. Headquarters

- Thomas & Betts Corp Headquarters

- Thompson Power Systems Headquarters

- Thorco Industries Headquarters

- Thoroughbred Nissan Headquarters

- Three-Five Systems Inc Headquarters

- Thriftway Foods Headquarters

- Ticketmaster Headquarters

- Time Warner Inc. Headquarters

- TMC Healthcare Headquarters

- TM Menards Login.

- Tobacco Express Headquarters

- Townsends Inc Headquarters

- Town & Country Ford Headquarters

- Toyota Motor Manufacturing Co Headquarters

- Toyota Motor Sales, U.S.A., Inc. Headquarters

- Toys R Us Headquarters

- Tractor & Equipment Company Headquarters

- Traders & Farmers Bank Headquarters

- Trailmobile Headquarters

- Trane Residential Systems Headquarters

- Trendwest Resorts Headquarters

- Trident Seafoods Corp Headquarters

- Triumph Turbine Service Inc Headquarters

- Troy State University System Headquarters

- Tucson Carpentry Headquarters

- Tucson Electric Power Co Headquarters

- Tucson Fuel Co Headquarters

- Tucson Medical Ctr Headquarters

- Tucson Newspapers Headquarters

- Tucson Water Headquarters

- Tumblr Headquarters

- Turner/Universal Headquarters

- Tuscaloosa Cnty Bd of Educatn Headquarters

- Tuttle-Click Headquarters

- Tween Brands, Inc. Headquarters

- Twin City Bank Headquarters

- Twin Rivers Foods Inc Headquarters

- Twitter Headquarters

- Tyson Breeders Inc Headquarters

- Tyson Foods Inc Headquarters

- Tyson Of Bentonville Headquarters

- T-Mobile Headquarters

U

- Uab Headquarters

- UAMS Medical Ctr Headquarters

- Uap Timberland LLC Headquarters

- Uber Headquarters

- UIC Headquarters

- Unilever Bestfoods Headquarters

- Unilube Inc Headquarters

- Union Foundry Headquarters

- Unisea Inc Headquarters

- Unisource Energy Corporation Headquarters

- United Airlines Headquarters

- United Auto Headquarters

- United Bancorporation-Alabama Headquarters

- United Bank Headquarters

- United Beverage Company Headquarters

- United Dairymen of Arizona Headquarters

- UNITED Defense Steel Prod Div Headquarters

- United Healthcare Insurance Company Headquarters

- United Security Bancshares Inc Headquarters

- University Bookstore Headquarters

- University Medical Ctr Headquarters

- University of South Alabama Headquarters

- University South Ala Hospitals Headquarters

- University-Arkansas Med Sci Headquarters

- Uni Source Energy Corp Headquarters

- UOP Molecular Sieve Dept Headquarters

- UPS Headquarters

- USAA Headquarters

- USA Drug Headquarters

- USA Medical Ctr Headquarters

- USA Truck Inc Headquarters

- USF Bestway Headquarters

- Usnr-Hot Springs Headquarters

- US Airways Group, Inc. Headquarters

- US Capital Mortgage Headquarters

- US Electrical Motors Headquarters

- US Veterans Hospital Headquarters

- US Veterans Medical Center Headquarters

- U S Food Svc-Pya Monarch Headquarters

- U-Haul Rental System Headquarters

- U.S. Bankcorp Headquarters

V

- Veco Corporation Headquarters

- Ventana Medical Systems Inc Headquarters

- Verizon Wireless Headquarters

- VF Jeanswear Headquarters

- Viad Corp Headquarters

- Victoria’s Secret Stores, Inc. Headquarters

- Victor Midland Inc Headquarters

- VICWEST USA Headquarters

- Virco Manufacturing Corp Headquarters

- Vistaprint Usa, Incorporated Headquarters

- Vital Processing Services LLC Headquarters

- Volusion Headquarters

- Vonage Holdings Corp. Headquarters

- VT Miltope Headquarters

- Vulcan Materials Company Headquarters

- Vulcan Threaded Products Inc Headquarters

- V C C Headquarters

W

- Walgreens Pharmacy Headquarters

- WalmartOne Login – One.Walmart.com

- Walmart Call Off Sick Number & Sedgwick Walmart Leave of Absence

- WalMart Headquarters

- Walmart Supercenter Headquarters

- Walter O Boswell Memorial Hosp Headquarters

- Warren Unilube Inc Headquarters

- Washington Regional Med Ctr Headquarters

- Watson Chevrolet Inc Headquarters

- Wayne Farms Headquarters

- Webb Del Corporation Headquarters

- Weblink Wireless Inc Headquarters

- Wellborn Cabinet Inc-Woodyard Headquarters

- Wells Fargo Headquarters

- Wendy’s Headquarters

- Western Union Headquarters

- West Point Stevens Headquarters

- Weyerhaeuser Co Headquarters

- Whirlpool Corp Headquarters

- White County Medical Center Headquarters

- White Electronic Designs Corp Headquarters

- WHITE River Health System Headquarters

- White Rodgers Div Headquarters

- Whole Foods Market, Inc. Headquarters

- Willamette Industries Inc Headquarters

- Willis Shaw Express Inc Headquarters

- Wincup Headquarters

- Windstream Corp Headquarters

- Wingfoot Commercial Tire Systs Headquarters

- Wireless Retail Inc Headquarters

- Wise Alloys Headquarters

- Wolverine Tube Inc Headquarters

- Wood Mfg Co Headquarters

- Worthington Steel Co Headquarters

- www.Prepaidgiftbalance.com

- W L Gore & Assoc Inc Headquarters

- W L Halsey Grocery Co Headquarters

- W M Grace Company Inc Headquarters

Hi,

Those who are out of work or who simply want to make a little extra money on the side may be wondering how they can get started making money online.

I was wondering if you’d post an article from me on the topic. In it, I’ll include advice on everything from how to assess your marketable skills to where to find opportunities to what you need to know about paying taxes on what you earn, and more.

If I send it over, would you post the article for your readers?

Thank you!

Cherie

I appreciate your article very well, the content as well as the attached images you share with me, I will definitely share it with my friends, wish you always good health and write more blogs. Please

This is really a great article I really like and will definitely share it widely with my friends, wish you always have good health and make more articles in the future. thank you

I want to complain about a co that you advertised on Facebook of which I ordered from last month to cut a long story I ordered & paid for from Fairymin.com a folderble mobile there price £19.99 they sent me in pods instead well I’m deaf so they arnt any good to me I have been in touch with them many times to no avail I don’t have the original ad but I do have recept and order like to also point out while trying to find original ad on Facebook I came across quite a few different named co offering same thing so it’s probably one of the same please look into this for me thankyou Theresa

Thank you so much for posting this directory of info. After contacting several companies I have had some serious issues with, 3 followed up with me the very next day. With 2 of them refunding me my money and apologizing for the issues.

Good info and right to the point. I am not sure if this is in fact the best place to ask but do you people have any thoughts on where to employ some professional writers? Thank you 🙂

Good info and right to the point. I am not sure if this is in fact the best place to ask but do you people have any thoughts on where to employ some professional writers? Thank you 🙂

1. I submitted a review on this site but it was not posted.

2. I filled out and submitted the online contact form requesting contact from this site but no responded.

3. Other reviews/complaints about the company in question have since posted, but not mine though it doesn’t contain any information or language that could be interpreted as a violation or otherwise, inappropriate.

4. What should someone do when you do not respond to requests for contact?

tremendous issues here. I am very glad to see your post. Thanks so much and i’m having a look forward to hearing from you. Will you please drop me a mail?

I liked as much as you will receive performed right here. The caricature is attractive, your authored material stylish. nevertheless, you command get got an shakiness over that you wish be handing over the following. ill surely come further in the past again since exactly the similar nearly very often inside of case you protect this hike.

I received a email from Goggle which states some of my passwords have been compromised.

I need to know if this email truly came from Google.

I have not opened it depending on your response.

Thanks. Warren

Great site, thanks! Left a review 🙂

I recently changed providers from At&t. I called the help desk several times and talked to several different individuals. For some reason after paying off my iphone7 and paying my bill in full the provider I chose to use was unsuccessful in being able to switch the iPhone 7 to their service. I called help desk to unlock phone and I got the run around many times. I did however speak to someone that really wanted to help and asked her supervisor to get involved in unlocking the iPhone7. I received an email stating the phone did not need an unlock code. Went to new provider and well over 3 hours later, unsuccessful in my contacts and information could not be used on the iPhone7.

Someone please call me and help me understand why the iPhone7 cannot be used with a different provider….

Thank you for providing this great directory!